The HVAC market is estimated to grow at a CAGR of 6.5% between 2022 and 2027. The size of the market is forecast to increase by USD 74.02 billion. The growth of the market depends on serval factors, including the growing of the construction sector, the rising preference for condensing boilers, and the increasing refurbishment and replacement demand.

This report extensively covers market segmentation by type (HVAC equipment and HVAC services), end-user (non-residential and residential), and geography (APAC, Europe, North America, Middle East and Africa, and South America). It also includes an in-depth analysis of drivers, trends, and challenges. Furthermore, the report includes historic market data from 2017 to 2021.

Parent Market Analysis

The reports categorize the global HVAC market as a part of the Electrical Components & Equipment. The parent market, the global electrical components, and equipment market cover companies engaged in the manufacturing of electric cables and wires, electrical components, and electrical equipment. Our research report has extensively covered external factors influencing the parent market growth during the forecast period.

HVAC Market: Key Drivers, Trends, Challenges, and Customer Landscape

The growing construction sector is notably driving the market growth, although factors such as lack of skilled labor may impede the market growth. Our researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key HVAC Market Driver

The growing construction sector is notably driving the HVAC market growth. The construction sector plays a major role in driving the demand for HVAC systems. With the increase in the construction of commercial and residential buildings globally, the demand for HVAC equipment and services has been increasing, thereby driving the growth of the global HVAC market. An increase in the trend of green buildings owing to growing environmental concerns will drive the demand for HVAC systems.

Office buildings and high-rise buildings adopt HVAC systems for maintaining the temperature within the building premises. Similarly, residential use of HVAC systems is on the rise, particularly in hot regions such as APAC and the Middle East. Design enhancements in housing constructions and an increase in the number of building permits are fueling the increase in demand for ACs. The commercial building sector has seen an upswing in office construction activities, particularly for the technology and finance firms. This is due to an increase in private investments. Similarly, hotel and hospital construction activities will propel the demand for HVAC systems. Such development is estimated to drive the market in focus during the forecast period.

Key HVAC Market Trend

The rise in the incorporation of building automation systems is the primary trend in the HVAC market. BASs, which control and monitor HVAC and other facilities of a given building, are embedded with computing and digital communication tools that allow these systems to enhance energy efficiency. The number of integrated BAS installations has increased owing to the rise in the number of construction projects and building retrofits.

The BAS technology has advanced features owing to improvements in sensor technology, availability of cheaper and faster communication systems, and improved user interfaces. Manufacturers are implementing open protocols, including the Internet protocol, to provide improved control solutions. BAS is becoming a common technology for enhancing the interaction and operability among HVAC, lighting, fire, and security control units of a building. The energy efficiency ensured by the ever-improving BAS technology enables building owners to enhance facility management with integrated user-friendly HVAC solutions. Such benefits are expected to propel the growth of the global HVAC market during the forecast period.

Key HVAC Market Challenge

The lack of skilled labor is the major challenge impeding the HVAC market growth. Manufacturing advanced modern HVAC systems and providing aftermarket services are the most important factors for HVAC manufacturers. Technical skills and knowledge are mandatory while installing or handling any type of HVAC system. At present, retaining and finding skilled labor are the major challenges faced by HVAC contractors. The shortage of labor will affect the profit margins of manufacturers as aftermarket services are affected.

A massive shortage of skilled manpower has plagued contractors for several years and is expected to continue during the forecast period. The inclination of fresh graduates toward more popular career paths, such as computer programming, application designing, and investment banking, instead of lesser calling jobs, is the primary reason for the shortage of technical workers. HVAC companies are facing challenges in filling up HVAC technician job openings. With the shortage of skilled personnel and an oversupply of owners, contractors will need to be more vigilant in recruiting new talent. Companies lacking desirable benefits and advancement opportunities may fail to sign in vital talent, which is required to keep their businesses running. Such factors may hinder the growth of the market in focus during the forecast period.

Key HVAC Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

What is the Fastest-Growing Segment in the HVAC Market?

The market share growth by the HVAC equipment segment will be significant during the forecast period. The growing population and industrialization, the rise in construction expenditure, the increase in sales of commercial and residential buildings, and the augmented disposable income of the middle-class population are driving the global HVAC market. Heat pumps, air-conditioners (ACs) in rooms, and unitary ACs are likely to witness significant demand in both residential and non-residential buildings.

The HVAC equipment shows a gradual increase in the global market share of USD 106.96 billion in 2017 and continue to grow by 2021. Furthermore, HVAC manufacturers are focusing on developing cost-effective and high-quality equipment that meets energy efficiency and green technology regulations. To meet the standardization and regulations for HVAC, many players are developing eco-friendly and sustainable equipment that reduces chlorofluorocarbon (CFC) and HFC emissions. Therefore, the growth of this segment is increasing due to the rise in demand for such technologically advanced and eco-friendly products.

Which are the Key Regions for the HVAC Market?

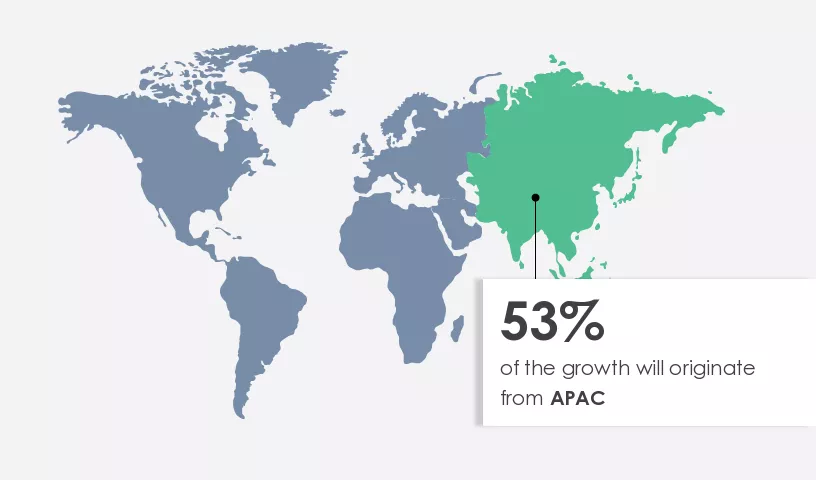

APAC is projected to contribute 53% market share in 2023. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

APAC is the largest market for HVAC systems due to the growing population, climatic conditions, increasing urbanization, and demographic changes in the region. The expanding commercial construction sector is the key driving factor for market growth in countries such as China and India. Regulations and efficiency norms in countries such as India and China will drive the HVAC market in APAC during the forecast period.

The population in various countries of APAC is growing. This population growth is leading to an increase in demand for new residential houses in the region. In addition, population growth and urbanization in this region have increased the need for smart and sustainable infrastructure solutions. As a result of this, various enterprises in this region are investing in the construction of residential buildings. The rising number of setups in the countries such as China, India, and Japan has resulted in the launch of compact air conditioning and air handling equipment launched in the region. Vendors are focusing on providing energy-efficient air-conditioning and ventilation systems in a compact package to further increase their market share in fast-growing countries in the HVAC market in APAC. Such developments are expected to further increase the penetration of air conditioning systems in the medium and small residential and non-residential segments in the region during the forecast period.

In summary, the growing construction sector is notably driving the HVAC market growth. Time flies! There are only one month left in 2022. To thank our customers for their attention and support over the past year, Holtop launched a series of preferential policies for energy recovery ventilators, air disinfection boxes, single-room ERVs, and newly developed products. Some of them are ready in stock with limited quantity. It’s time to prepare some heat recovery ventilator products with such preferential prices at the end of the year. If there is a full container of goods, Holtop also provides some additional discounts as well.

HRV/ERV: Residential ERV/HRV Factory, Suppliers – China Residential ERV/HRV Manufacturers (holtopglobal.com)

Heat Exchangers:Heat Exchangers Factory, Suppliers – China Heat Exchangers Manufacturers (holtopglobal.com)

Air Handling Units: AHU Factory, Suppliers – China AHU Manufacturers (holtopglobal.com)

For more information, please click: https://www.technavio.com/report/hvac-market-industry-analysis