1. Headline This Week: Can India Become the Second AC Powerhouse after China? — Middle Class Expansion Holds the Key

India is also attracting attention as a production base for air conditioners, supported by high tariffs and protection policies governing domestic production. The supply chain is being strengthened, and more manufacturers are starting domestic production of compressors, the main components of air conditioners. For example, Guangdong Meizhi Compressor (GMCC) and Daikin are planning domestic production, and Highly will also build a plant jointly with Voltas, a local air conditioner manufacturer.

As such, the Indian air conditioner market has been attracting more attention recently, but it first began to attract the attention of manufacturers as a promising emerging market more than 20 years ago. Since then, Japanese, the U.S., South Korean, European, and Chinese manufacturers have been focusing on developing the Indian market.

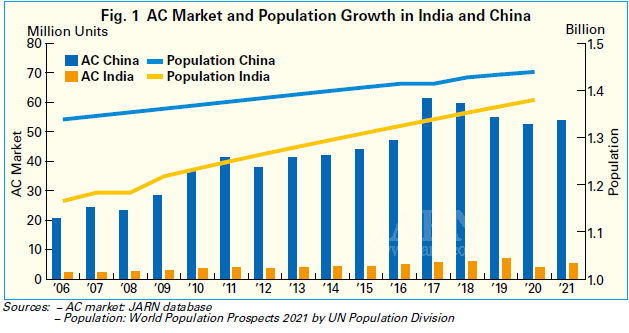

However, although India was expected to become the second-largest air conditioner market after China, the Indian market has not actually grown as expected. As shown in Fig. 1, the Chinese air conditioner market has achieved rapid development since the 2000s, while the Indian market has seen an increasing trend, but the growth rate has remained moderate. Having the second largest population after China and many hot regions, it is safe to say that the Indian air conditioner market could grow to the same level as China’s. But why has it been growing moderately? In response to this question, JARN looked at several explanations.

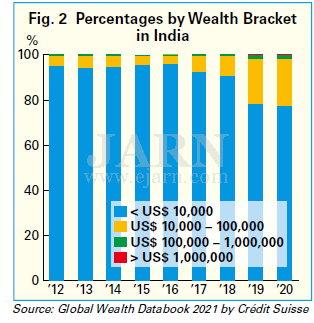

The major reason that Indian air conditioner demand did not grow sharply is considered to be related to slower than expected expansion of the middle class. The middle class has stable purchasing power and should be the core air conditioner purchasing group. According to the World Economic Outlook October 2021 from the International Monetary Fund (IMF), India’s real gross domestic product (GDP) in 2021 was 9.5, one of the highest growth rates in the world, but the economic disparity is wide. As shown in Fig. 2, the proportion of adults with assets of less than US$ 10,000 has been overwhelmingly high in India, accounting for more than 90% from 2012 to 2018, according to the Global Wealth Databook 2021 from Crédit Suisse. Although the ratio has been declining since 2019, it still surpassed 77% in 2020. On the other hand, there is also a wealthy class with assets of over US$ 100,000, such as those involved in the information technology (IT) industry that is driving the Indian economy and generating high annual income.

A major cause of this asset disparity is said to be the caste system, which is already prohibited by law but persists nevertheless. In India, it is difficult for the low-income group to enter a high-income profession because the surname indicates the former status, and it is difficult to get out of poverty. That has resulted in a stagnant middle class. Without consumption created by the middle class, demand for durable consumer goods such as air conditioners cannot be expected to increase. Air conditioner prices are also rising because the Indian government has raised tariffs on imported air conditioners and their components such as compressors in the context of domestic industrial protection policy. As a result, air conditioners have become increasingly inaccessible luxury products for the low-income group, which is one of the reasons why the air conditioner penetration rate has been slow to increase.

Meanwhile, manufacturers are facing a major obstacle: that is, difficulty in efficiently developing the air conditioner business in India. Specifically speaking, India has a large land area and different climate characteristics in each region, so manufacturers must have different air conditioner models that are suitable for each region. In addition, manufacturers must deal with complicated legal procedures related to different laws in different states, which takes time, and the flow from production to sales and delivery does not go smoothly.

Another major obstacle for manufacturers is high tariffs. Tariffs on raw materials used in domestic production also have been gradually rising, which is a heavy burden for manufacturers entering the market. Originally, tariffs were raised to accelerate the attraction of foreign capital, but many overseas investors hesitate to expand into India if they cannot expect a return on investment. Given the fact that Brazil, which planned to attract local air conditioning production under raised tariffs, has not yet seen significant results, there is concern that India could follow the same path.

Even so, given the large population centered on young generations and the generally hot climate, India certainly has great potential for air conditioner demand. For a long time, India has seen collapsing air conditioner prices, due to low-priced locally assembled products with imported parts used by local manufacturers. With foreign manufacturers such as Japanese players that have been participating in domestic production, a healthy market will be built up gradually, with improving quality of air conditioners, strengthened energy efficiency, and optimized retail prices. In the future, there is a possibility that air conditioners unique to India will be created by incorporating IT-based software, which India is good at, into hardware.

On top of that, in order to stimulate domestic demand for air conditioners, it is essential to expand the middle class. If the Indian economy improves constitutionally and the middle class expands, the consumption of air conditioners that improve the living environment is expected to increase. However, it seems that there is still a long way to go before India grows into an air conditioning powerhouse following in the footsteps of China, with rapid expansion of demand.

2. Market news: Heat Pump Sales Soar in Finland

Sales of heat pumps soared during the first quarter of 2022 in Finland. According to statistics from SULPU, Finnish Heat Pump Association, sales of air-to-air (ATA) heat pumps grew by as much as 120%, air-to-water (ATW) heat pumps increased by 40%, and ground-source heat pumps (GSHPs) by 35%. The sales volume of exhaust-air heat pumps for single-family houses remained unchanged. Approximately 30,000 heat pumps were sold during the first quarter of 2022. The total volume increased by 90% compared with the same period last year. This growth veered towards high-performance pumps, which means that the increase in sales was even higher in terms of value.

Reasons for this huge increase include subsidies for the replacement of oil boilers and the improvement of their energy efficiency, along with rising energy prices. The profitability of heat pumps improved further. More than one million pumps have already been installed, and Finns are now very familiar with heat pump technology, which has gained a reputation for being reliable. Russia’s war against Ukraine also raised demand for heat pumps. Finns are seeking alternative ways of heating their houses – ways that are based on self-produced energy.

A dire shortage of components and equipment along with a shortage of design, entrepreneurship, and installation resources have resulted in a major challenge to the heat pump sector. Delivery times for energy wells can be up to six months, and backlogs for permits provided by municipalities and towns are hindering the sales and installation of ground-heat projects in particular.

The current impressive sales figures would be even higher if heat pumps and resources were able to keep pace with demand.

3. HVAC Trending: Chinese Manufacturers Shifting Focus to Central ACs

In a context of fierce ongoing price wars in the room air conditioner (RAC) segment, Chinese manufacturers are finding it difficult to make a profit in this segment and are turning to the central air conditioner segment as a new profitable development area. In China, the central air conditioner segment includes unitary systems, variable refrigerant flow (VRF) systems, and chillers.

According to data from aircon. com, the Chinese central air conditioner market hit a new record high sales level in 2021 with more than 25% year-on-year growth, after exceeding RMB 100 billion (about US$ 15 billion) sales for four consecutive years. Such rapid growth is attractive for many air conditioner manufacturers which have been struggling to make profits.

One of the growing segments for central air conditioners in 2021 was the home refurbishment segment that recovered from the negative impact of real estate control policies in previous years. Another factor was infrastructure projects with growing national investments during the pandemic. In particular, the construction of schools, hospitals, and activity centers increased. Engineering projects also grew by more than 25% in 2021, thanks to an increase in infrastructure projects related to information and new energy vehicles. There will be more construction of fifth generation (5G) base stations, data centers, industrial parks with artificial intelligence (AI) and Internet technologies, etc., under the Chinese Information Super Highway Plan, for not less than a decade.

Of central air conditioning products, VRFs and centrifugal chillers drove the market with higher than average growth rates, while growth of water-cooled screw chillers and unitary systems remained low. VRF sales were pushed up by demand from real estate projects and home refurbishment, while sales of centrifugal chillers and modular chillers were driven by engineering projects.

According to data from aircon.com, leading central air conditioning brands in China include Gree, Midea, Daikin, Hitachi, Haier, Toshiba, McQuay, YORK, TICA, Hisense, Mitsubishi Heavy Industries-Haier, Shenling, Mitsubishi Heavy Industries Thermal Systems (MHI Thermal Systems), Carrier, and Trane. In addition, heat pump manufacturers entered the central air conditioner segment in 2021 with reversible airto-water (ATW) heat pumps, unitary systems, VRFs, and modular chillers.

Aiming at higher profits, many air conditioner manufacturers in China have increased their investments in and expanded their central air conditioning production capacity in 2021 and 2022.

For more information, please visit: https://www.ejarn.com/index.php